Although mortgage interest rates have started to fall, house prices remained “resilient” in 2023 according to Kim Kinnaird, director at Halifax Mortgages.

According to the Halifax house price index, UK house prices rose by +0.5% in November, making the average now £283,615.

This is welcome news for existing homeowners and the market as a whole, but it remains a challenge for first time buyers with even bigger deposits to save.

But with a little know-how, discipline and guidance from experts, your dream can most definitely become a reality, and faster than you may think.

To help with that, here are my 5 ways to boost your home buying deposit and finally get things moving.

1 — Gifted Deposit

Also known as “the bank of Mum and Dad”, this is one of the most common ways of boosting your deposit.

The gift would also need to be non-refundable, with the donor having no interest in the property, including its eventual sale.

2 — Buy With Friends or Family

For those who don’t have anyone who could gift the deposit, have you considered buying with a friend?

In most cases, lenders will require non-relatives named on the mortgage to be residing in the property.

As long as this is the case, it’s a viable option.

3 — Vendor Paid Deposits

Some lenders will consider a small percentage of the deposit (usually max 5%) as a gift from the seller, such as a new build developer for example.

In some cases, a landlord may gift part of the equity to a tenant wishing to buy the property they are renting.

The criteria do get a little more complex for this scenario, so it’s best to check this with an expert mortgage adviser.

4 — Get Savvy With Saving

Open a Lifetime ISA.

Instead of saving into an instant access savings account, if you are aged between 18 and 39, you can save up to £4000 per year into a LISA and the Government will boost your savings by an extra 25% as a savings bonus.

This means you could get an additional £1000 per year on top of your savings.

5 — Reduce Everyday Spending

This seems really obvious, but the money you save on everyday expenditures can help to boost your deposit over a relatively short space of time.

Look at your monthly spending habits.

Start by going through your bank statements over the previous month and identify what is necessary and what you can ditch, such as buying coffee or lunches at work.

Is there anything you can do to cut back on? If you currently rent a property, could you renegotiate your energy bills or contracts like broadband, for example?

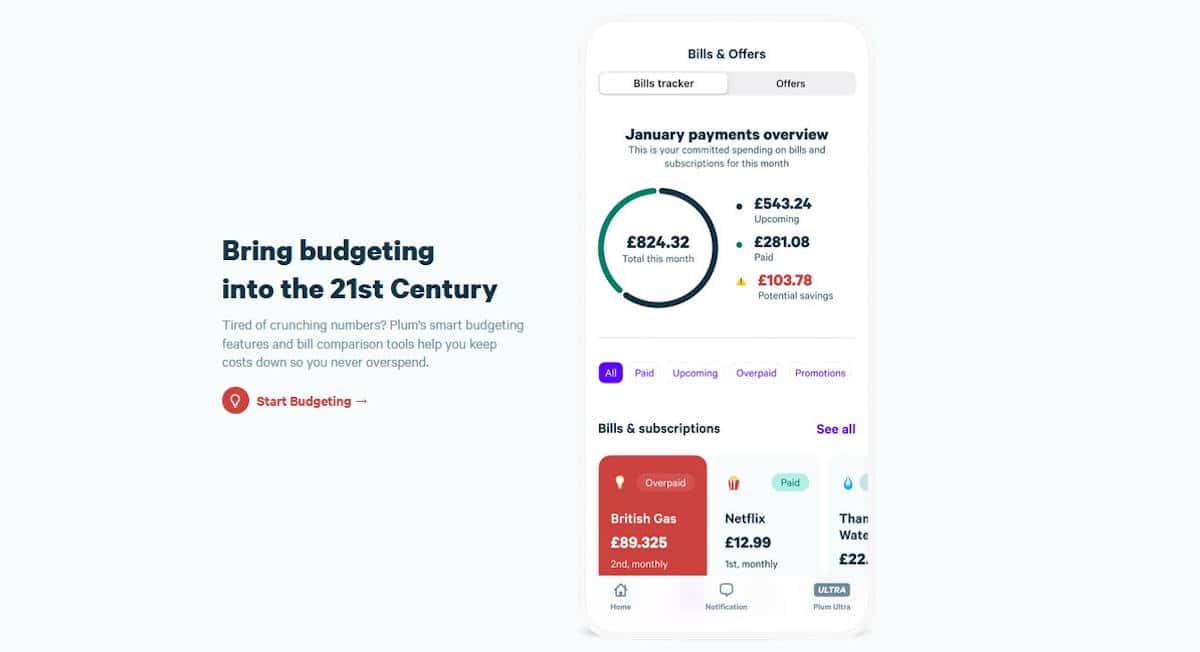

I’d recommend you track your outgoings for 30 days to see where you could save money, then move the savings you make into your savings account.

You’ll be surprised how quickly your savings can accumulate over a short space of time.

Consider saving money by cutting back on things like bringing your own lunch to work, and use a budgeting app to help you track your progress.

The key here is to be consistent and patient with your savings.

What is The Average Home Buying Deposit for a First-Time Buyer?

This largely depends on the location of a property, as house prices vary from area to area in the UK.

According to a report published by Statista in Sep 2023, in 2022 the national average was £62,470 or 20% of the house price. In London, the average house buying deposit was more than double that.

The important thing to note is that you will need a minimum deposit of 5%, which based on a house price of £200,000 means you would need a £10,000 deposit.

Once you have a minimum of a 5% deposit based on the typical price of your ideal house, get in touch to book a free consultation to review your budget and affordability requirements.